Advanced Trading Strategies and Market Analysis

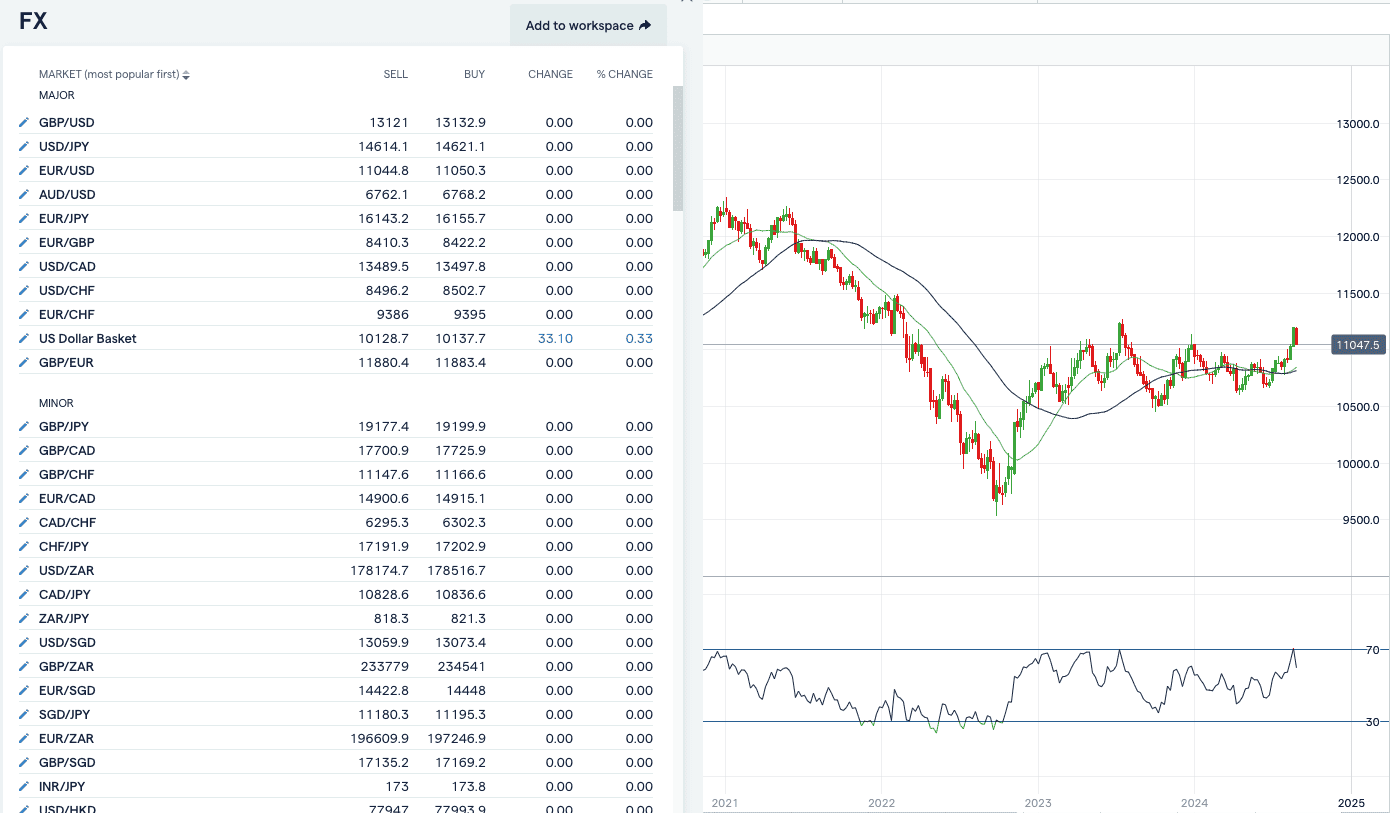

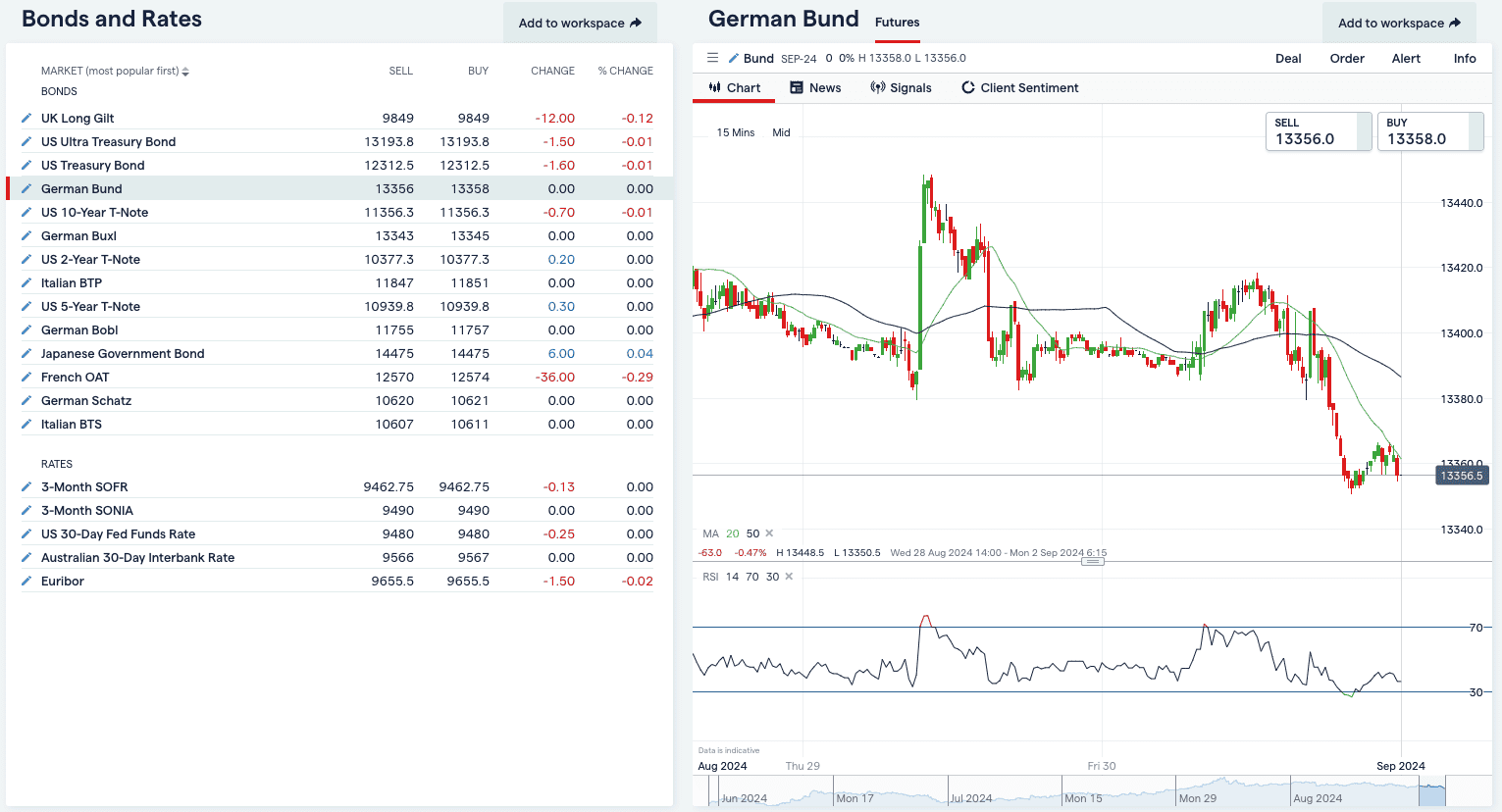

Professional financial betting demands sophisticated analytical approaches that go beyond basic chart reading. Advanced practitioners employ quantitative analysis, algorithmic trading systems, and multi-timeframe technical analysis to identify high-probability opportunities across various financial markets.

Market sentiment analysis plays a crucial role in successful financial betting strategies. By monitoring institutional positioning, retail trader behavior, and options flow data, experienced participants can anticipate potential market reversals and capitalize on crowd psychology. This comprehensive approach combines fundamental economic analysis with technical indicators to create robust trading frameworks.

Risk management remains the cornerstone of sustainable financial betting success. Professional traders implement strict position sizing rules, utilize stop-loss orders effectively, and maintain diversified portfolios across multiple asset classes. These disciplined approaches help preserve capital during adverse market conditions while maximizing returns during favorable periods.